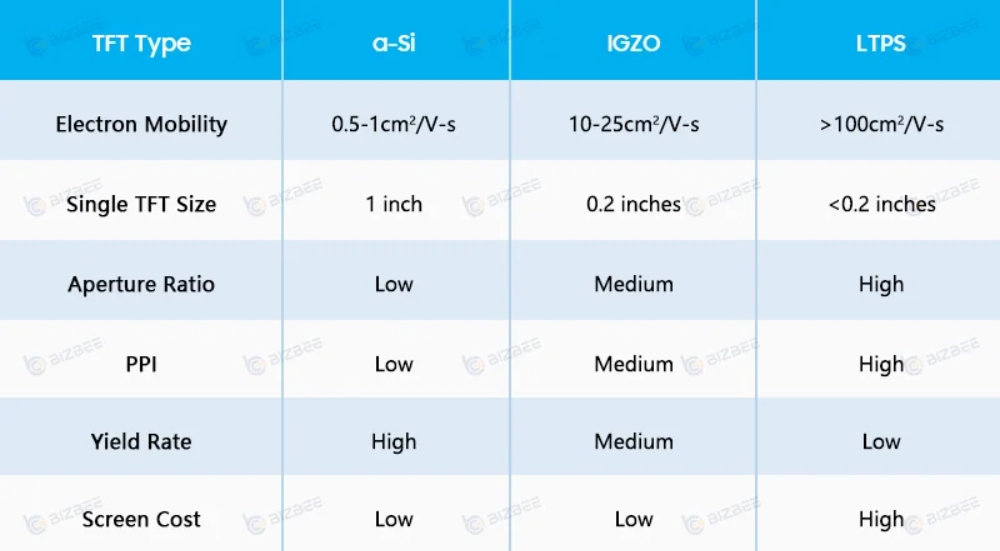

There are mainly three types of thin-film transistor technologies used in flat-panel-display according to the difference in substrate material used for TFT channel layer, namely, a-Si (amorphous silicon), LTPS (low temperature polysilicon) and IGZO (indium gallium zinc oxide).

Early TFT-LCDs were mainly based on a-Si backplanes, but its electron mobility was low. LTPS and IGZO backplanes can greatly increase the electron mobility, thereby better achieving high resolution, high brightness, narrow bezel, and low power consumption and other desirable features, but IGZO is sensitive to moisture and oxygen, which makes encapsulation process more sophisticated and challenging, and is mainly used in high-end laptops and high-end tablet markets; LTPS requires ion implantation and rapid annealing processes, and is difficult to produce medium and large-sized panels. So, it’s mainly used in the smartphone, tablet market.

(1)a-Si technology is mature and suitable for all sizes of product

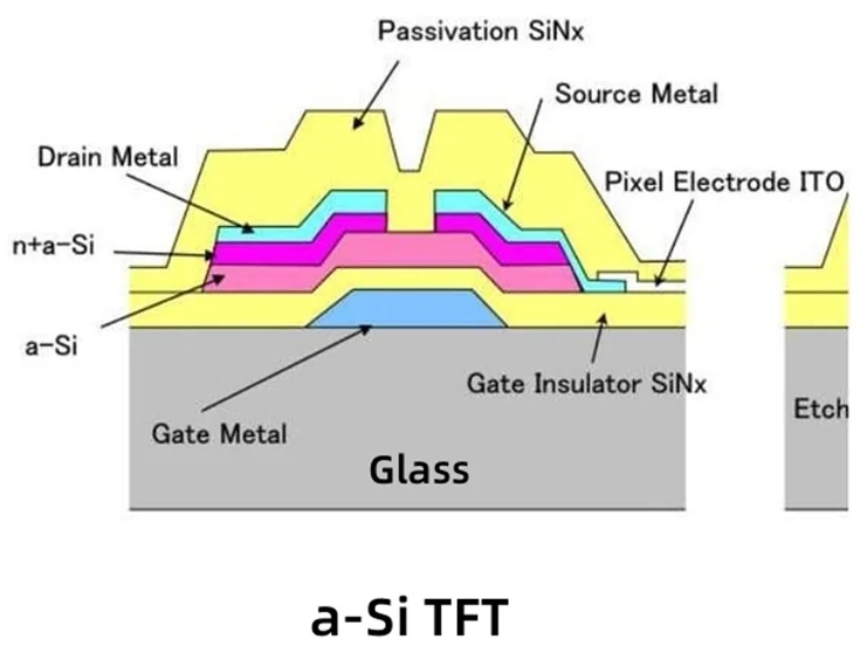

At the outset of the development of TFT-LCD technology, amorphous Silicon (a-Si) was widely used in the replacement for CRT. The fabrication process of an a-Si transistor backplane requires only 4–5 photo masks, and it results in N-type only devices.

Due to its maturity, stability and low cost, a-Si technology can achieve high yields on mainstream display products of all sizes. Therefore, it is suitable for all segments, such as TVs, desktop monitors, laptop computers, automotive displays, and other applications. It also has high cost-effectiveness advantages in the mobile phone market.

Its shortcoming is that the display quality such as color saturation and clarity are poor. Currently, the application field has been relegated to the mid-to-low-end smartphone, vehicle-related and other specific display markets.

(2)IGZO can be used in small and large sizes

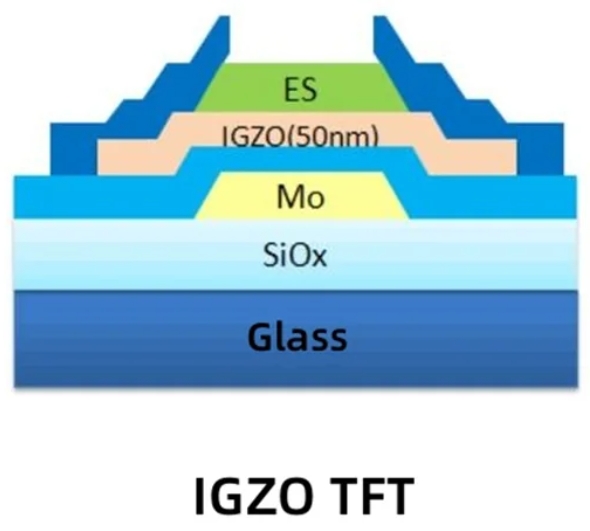

IGZO is the abbreviation of Indium Gallium Zinc Oxide. It is a thin film transistor technology that refers to a layer of metal oxide on top of the active layer of TFT-LCD. Research has found that a series of metal oxides have similar features and are therefore collectively known as Oxide TFTs. IGZO is one of the most famous one among them.

In March 2012, Sharp became the world’s first manufacturer to adopt IGZO technology for LCD panels and mass production. In recent years, Sharp’s IGZO technology has continued to evolve, and it has now announced the completion of the research and development of the 5th generation IGZO. It will be more power-saving, support 8K and can be applied to OLED panels.

The IGZO process temperature is low which allows transparent substrates to be used to produce bottom-emitting structures. It can also be applied in the production of large-size products including flexible OLEDs, which is a key technical direction for top manufacturers.

(3)LTPS can only be used in small sizes

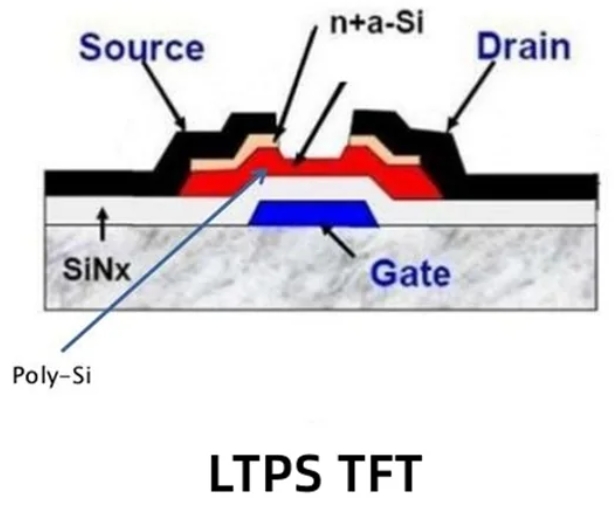

LTPS, which stands for Low Temperature Polycrystalline Silicon, is a key process for small and medium-sized high-resolution TFT-LCD and AMOLED displays. LTPS also refers to a physical transformation in which amorphous silicon absorbs internal atoms to undergo energy level transitions and transforms into a polycrystalline structure after being uniformly irradiated by laser light.

![]()

Compared with a-Si technology, LTPS requires a laser crystallization process, turning a-Si into p-Si (polycrystalline silicon) with a smaller TFT size and a higher electron mobility rate. The high electron mobility of LTPS brings many benefits to TFT-LCD. Since the size of TFT in LTPS is smaller, a higher aperture ratio and narrow bezel can be obtained. High aperture ratio reduces backlight power consumption. Because the register capacitance becomes smaller, the smaller TFT size reduces the driving power consumption. LTPS TFT has higher pixel density than a-Si TFT since LTPS TFT can integrate gate drivers on the glass substrate to overcome interconnect spacing limitations. What’s more, LTPS with silicon oxide gate insulator has proven to be reliable in performance because it has lower defect density.

Most existing flexible panels are manufactured using LTPS technology. Although LTPS technology has high carrier mobility, it is difficult to apply to high-generation lines (big size glass substrate) due to laser annealing processes and other reasons, and its uniformity is poor. Its higher process temperature (≥450°C) leads to the extreme requirements for the CTE (coefficient of thermal expansion) of the substrate material, and only a top-emitting structure can be used. Transparent metal cathodes have excessive resistance and are difficult to fabricate in large sizes, so they are only used in small sizes.

The ultimate goal of LTPS is to achieve the System on Glass (SoG) solution, that is, to produce all system circuits directly on the glass substrate through the LTPS process.

(4)LTPO: A combination of LTPS and oxide, Apple dominates this technology

Apple owns multiple patents for LTPO. Apple uses the fast switching and low leakage characteristics of IGZO to improve LTPS backplane technology, allowing circuits of LTPS and IGZO to be mixed and combined to form a new LTPO (low temperature polycrystalline oxide) backplane technology. It was successfully applied to the new generation of Apple Watch 5 for the first time in September 2019, achieving a balance between performance and power consumption. According to reports, Apple has been used OLED panels with low-power LTPO backplane in two iPhone models minimum since 2021.

Market Tendency and Forecasts

The PPI, low power consumption and narrow bezel of IGZO and LTPS technology are significantly higher than those of a-Si, but the process is more complex and the investment and cost are relatively high. While a-Si is dominating the TV and monitor market, IGZO and LTPS are nibbling away at market share of a-Si in mid-to high-end mobile, tablet and laptop.

According to IHS forecasts, in 2025, the share of LTPS TFT-LCD in the mobile phone panel market will decline from 36% to 33%, the share of IGZO TFT-LCD in the laptop computer panel market will increase from 12% to 21%. The market share of a-Si TFT-LCD for small and medium-sized products will decline to varying degrees. The share of the mobile phone panel market will drop from 43% to 30%, and the share of the laptop computer panel market will drop from 87% to 70%.